Restaurant Cost of Goods (or to some, Restaurant Cost Of Sales) takes up a significant amount of a restaurant’s overall expense. Unfortunately, many owners/operators fail to see how COGS for restaurants can significantly negatively impact profitability and cash flow if mismanaged or handled inconsistently.

Point-blank: It’s critical to the health and survival of all restaurants that you understand your COGS and how to manage them accurately – here’s how.

What is the Cost of Goods (COGS) formula for a restaurant?

What are COGs, and more specifically, how do they calculate? The COGS restaurant acronym stands for Cost Of Goods; some may also call it Cost Of Sales. When you see a cost on your P&L, it always uses the same calculation:

( OPENING INVENTORY + PURCHASES – CREDITS – ENDING INVENTORY ) / SALES = COGS

COGS formula breakdown

- Begin with your opening inventory: While reviewing your financial statements, this is your inventory at the beginning of the period, and is represented by the initial dollar amount of product on your shelves. If you’re reviewing weekly, this is your inventory at the beginning of the week. If you’re reviewing monthly or period-based, this is your inventory at the beginning of the month or period.

- Next, add in your purchases: This is the most straightforward – these are the purchases that you make throughout the week.

- From there, subtract any credits, and your ending inventory: Your ending inventory is the dollar amount of inventory remaining on your shelves at the end of your review period (i.e. monthly, period-based, or weekly).

- To evaluate the cost as a percentage of your sales, you’ll want to divide the dollar amount derived from the above steps into your sales. The final number paints a picture and starts to tell you how much money you’re making on the food and beverage you’re selling.

How to Calculate COGS?

Calculate your restaurant cost of goods sold with the COGS calculator below! Simply enter the dollar value of your opening, purchases, credits, ending inventory and sales…then click “Calculate COGS” to see your restaurant’s cost of goods percentage!

COGS formula tips

When reviewing the COGS formula, it’s important to understand that the basis of your sales is the sales for that respective cost basis, meaning your food cost is a percentage of food sales, liquor cost is a percentage of liquor sales, etc. You should have corresponding cost categories with your master sales departments; therefore, the percentage is based on the basis of your specific sales.

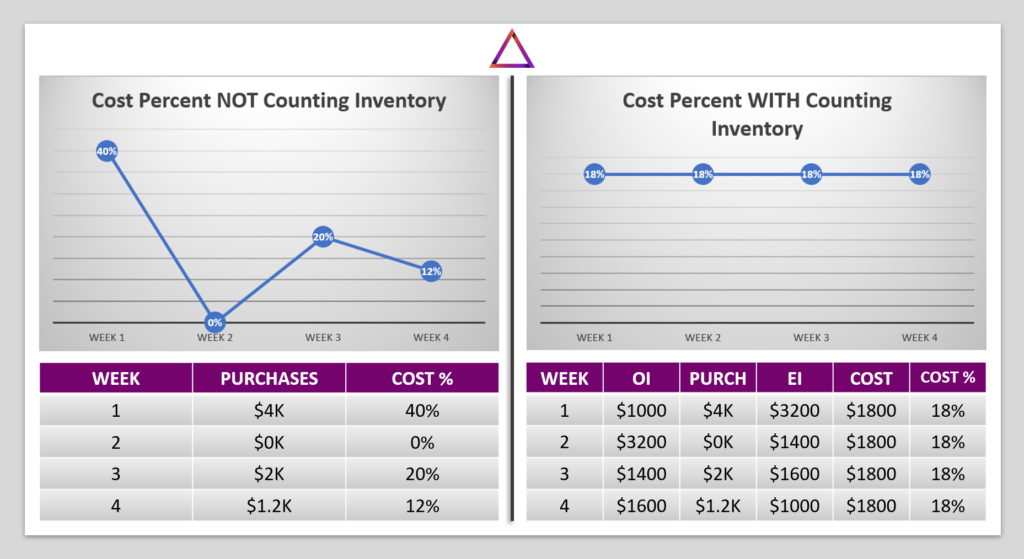

For operators who count inventory by the week, this formula is the most accurate way to calculate the product costs you’ve gone through during the week. If your restaurant doesn’t count inventory, change the opening and ending inventory to “zero.”

In doing this, understand that the formula still applies, but this means your cost is simply based on the following: Your purchases minus your credits, divided into sales. Your inventory is not factored in (because you do not take it so you don’t have an accurate number to insert into the formula).

Why should restaurants count their inventory?

Counting inventory is the best way to get an accurate representation of what your true usage is. Your inventory should be a total of all the food product, nonalcoholic beverage, beer, wine, liquor, (Note: For QSRs we suggest including your packaging in this as well), etc.

Additionally, when you count inventory you touch everything inside the restaurant. This includes all the equipment, the storage areas, walk-in freezers, etc. So, while you’re counting, you can simultaneously perform a facility maintenance check. In doing this, you’re able to catch any maintenance issues before they become a bigger problem.

Finally, remember that your total inventory dollars live on your Balance Sheet. This is recorded as an asset and represents the total dollar amount of product that you have on your shelf. Here are some top tips for a stabilized inventory:

- Try and keep your inventory as low as you can without running out of product

- The more inventory you have on hand, the less cash you have in your bank

- Reducing your total inventory will help free up some of that cash

- When reviewing your total inventory on hand, period over period, week over week, make sure you don’t have large swings that could negatively impact your cash

In the image above, the up and down “EKG chart” of your cost as a percentage of sales, when it’s only based on purchases, is not meaningful data.

All the best restaurant operators excel at troubleshooting ways to mitigate their waste. Additionally, they can determine if customer behavior changed or if an item is priced incorrectly. Operators who are able to do this so well utilize meaningful data to guide their troubleshooting.

When you’re counting inventory and have an expected cost percentage baseline, you’re enabling yourself to make, proactive, meaningful business decisions.

Best Practices in Counting Restaurant Inventory

- Two-person counting system

- Always have the same person call out the inventory and the same person record it

- Consistent counting units

- Make sure you count the product the same way each time

- Organize and Maintain Shelf-to-Sheet Count Sheets

- Try to make your count sheet flow in a way that’s shelf-by-shelf

- Keep inventory levels low

- Keeping inventory levels low helps you count product quicker as well as manage theft, spoilage etc.

- Low inventory helps with cash flow

- If you can’t consume it, don’t count it (unless you’re a QSR then you can and should include packaging)

- Utilize a declining spending budget to manage supplies (paper products and to-go packaging)

- These products should be budgeted out

- Utilize a declining spending budget to manage supplies (paper products and to-go packaging)

WATCH OUR COST OF GOODS 101 VIDEO:

Common Restuarant COGS misconceptions

- Purchases are the same as usage: FALSE

- Go back to the COGS formula. Just because you had x amount of purchases for the week doesn’t actually mean you sold all that purchased product

- If you’re not counting inventory, whether or not that product was actually sold, it should still be reflected as your cost for that week

- My cost is high because I purchased extra for the next period: FALSE

- Again, go back to the COGS formula. Higher purchases don’t have any bearing on your cost because you’re inventorying the product

- The usage is still what you actually utilize throughout that accounting period

- Again, go back to the COGS formula. Higher purchases don’t have any bearing on your cost because you’re inventorying the product

- Buying in bulk saves money: TRUE/FALSE

- This one is a catch-22. Just because you might save a dollar through bulk discounts, doesn’t mean that you’re going to use the product

- If you want to buy in bulk, be smart when you do it based on the history of your product usage

- Ask yourself if saving a dollar here and there is truly going to help you out in the long run

- Inventory is a time suck: FALSE

- Think of inventory as an investment – you have tens of thousands of products sitting on your shelf, which is an asset and an investment to the business

- Inventory should be properly received, manage, stored, and tracked

- The more accurate and consistent your inventory is, the easier it is to identify areas of opportunity and concern.

- Think of inventory as an investment – you have tens of thousands of products sitting on your shelf, which is an asset and an investment to the business

By engaging your management team in the inventory tracking process and having a real baseline on which they can make meaningful decisions, you’re ultimately going to save more money with the impact they can have, than the actual labor dollars it costs for them to perform inventory.

Managing food waste in your restaurant/bar

- Declining Spending Budget & Ordering PAR Levels

- Get your whole team involved in forecasting and make sure the order writers know the PARS should be as fluid as your sales are fluid

- How do you do this? Use a declining spending budget that keeps track of purchases throughout the week and tells you how much you have left to spend

- Get your whole team involved in forecasting and make sure the order writers know the PARS should be as fluid as your sales are fluid

- Waste tracking

- Go old-school. Use a clipboard or even a waste bucket in the kitchen to help quantify that waste

- If you insist on ringing it in through the point of sale, void that sale (with the category of waste) instead of comping or discounting it

- Make sure you check with your state to see what’s required with waste. This is especially relevant to liquor. Some jurisdictions require spillage to go through your POS to ensure it’s all accounted for

- W.E.P.T

- W: Waste – Is it truly waste like spoilage? Is it over-ordering on those PAR levels?

- E: Error – Is it a mistake in the way the servers are ringing in something through the POS? Do they know the difference between a void in a comp?

- P: Portion Size – Restaurants are businesses pennies, and if half an ounce of extra dressing is going on your salads, those pennies add up quickly.

- T: Theft – Is product going out the back door? Is it being given away to customers without being rung in?

- Keep inventory levels low

- Lower inventory levels are proven to minimize your waste

- The less product available, the less likely your staff is over-portion

- Keep in mind this is a delicate balancing act

- Never keep your inventory levels so low that you’re running out of product because that reflects poorly on your brand; Find the level that works for your restaurant

Bonus strategy to reduce restaurant food costs

If you’re not currently involved in any manufacturer rebate programs or Group Buying Organizations (GBO’s) then you might be missing some cost savings that could help decrease your overall cost. A group buying organization leverages the purchasing power of all its members to negotiate contracts with suppliers that end up benefiting everybody in that organization. As part of a larger group, you’ve got strength in numbers, which leads to lower product costs that you couldn’t attain on your own.

Building relationships with your direct vendors and reps from your food and beverage vendors can help you maximize the savings that the national corporate chains are actually getting from negotiating their rebate programs just by finding out what you’ve got available in your area. You can check with your main distributors to see what programs they might have available to you. Learn how joining a group purchasing organization can benefit your restaurant!

LISTEN TO THE FULL PODCAST EPISODE BELOW!

COGS Frequently Asked Questions

How does the COGs formula relate to other restaurant business processes?

The Restaurant COGs formula is calculated as the following:

(Opening Inventory + Purchases – Credits – Ending Inventory ) / Sales = COGs

COGs are weighted on the cost basis associated with it (food cost against food sales, beer cost against beer sales, etc). Most businesses (even those who don’t count inventory) will still customize their costing to determine the activity cost versus the sales activity that’s associated with it.

Should my COGS calculations for one restaurant generally apply to other restaurants in my franchise? If not, what are the main variables to account for?

Yes, the COGs formula should remain the same for all locations. If a restaurant is not counting inventory, the comparative results will vary because the COGs will be calculated solely based on purchases. Other variables will factor based on cost basis. The overall calculation will not change; however, comparative results will vary if, for example, a restaurant included NA beverage in their food cost and a bar within that same franchise considered it in their pour cost.

What is the best way to optimize inventory/supplies as it relates to COGS?

Weekly inventory is key to managing purchases. Running out of product negatively impacts both the team and guest experience. Over-ordering adds additional expense to the restaurant and results in potential impacts to WEPT (waste, errors, portioning & theft). Weekly inventory allows managers to set pars and adjust their weekly purchases in real-time.

Why do higher purchasing prices for inventory have little to no bearing on cost?

As long as you strategically manage orders based on sales, the inventory on the shelves should remain minimal. Therefore, the overall cost to the restaurant is not impacted. If costs continue to rise, menu costing becomes critical to ensure that your menu prices are adjusted to account for market inflation.

What is RASI’s general opinion on buying restaurant inventory in bulk?

While bulk purchases can provide discounts for the restaurant, they should only be done on items that have high-velocity sales within the restaurant. Purchasing in bulk on items that are not used within the period can increase counting errors, decrease item quality, lead to potential theft, and result in waste of product. While you might receive a discount, inventory on the shelf is still money on the shelf.

Can RASI assist with my restaurant’s declining spending budget?

Yes! Having a strategic budget in place and adjusting COGs on a weekly basis to account for sales trends is critical to effective ordering and cost control. RASI has cost analysis tools that allow you to enter current sales, compare them to budget, and adjust budget spend in real-time.

What percentage of food in my restaurant should be dedicated to inventory?

This will vary based on restaurant concept. A pizza parlor will have significantly different cost goals than a fine dining seafood restaurant. RASI can conduct a break-even analysis to determine what the COGs goals should be for your restaurant based on the concept and location of the business. In addition, RASI has tools to compare your restaurant against like-concepts to see how you stack rank against others in your competitive landscape.

Inflation is a major concern for my business. What are some other ways my restaurant can decrease food costs?

Weekly inventory, purchasing programs, and menu costing are the three best tools at your disposal to combat inflation and seasonal cost fluctuations. Weekly inventory allows visibility into trends and reduces fluctuations in costs. Purchasing programs can provide insight into products that are similar to the ones that you are using that are lower cost and provide the restaurant with rebates. Lastly, costing out your menu allows you the ability to determine menu items with high elasticity to make educated decisions around menu pricing.

Do all of RASI’s restaurant accounting services have built-in COGS analysis & tracking, or are some specific software applications more aligned with COGS?

RASI has COGs analysis at your fingertips with interactive widget reporting, real-time COGs reporting prior to submitting inventory, drill down financials with the ability to see invoices and counts directly from the P&L and item variance reporting.

I’d love to see a demo of your software in action, especially with COGS calculations and related activities. Are any demos available?

You can always request a free demo of our comprehensive restaurant accounting software at any time! Reach out here and immediately book time on one of our local business development representatives’ calendars!