Successfully closing out a period starts the domino effect for proactively operating a restaurant versus missed opportunities in the following periods. The purpose of the Period End Financial Close is accuracy verification to highlight where your money is going.

This enables you to make quicker, more educated business decisions.

To close out a period, begin with a review of the financial statements; The Profit & Loss Statement, The Balance Sheet, and The Cash Flow Statement.

Within each statement, defined areas of focus should pop out to an operator as a must-watch for success. In this episode of The Tip Share, RASI Director of Education, Brittany Ward discusses a few key items to concentrate on when conducting a Period End Financial Close: Accounts Receivable and House Accounts.

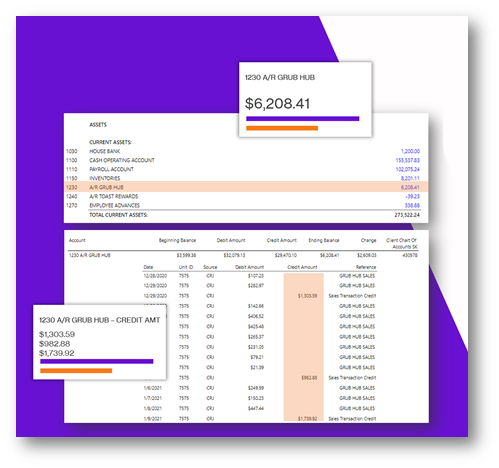

Closing Out Accounts Receivable:

Accounts Receivable reflects money that the restaurant is owed. Proper utilization and recording of the A/R Accounts allow full transparency into what is owed. This allows you to hold your partners accountable for reimbursement. In addition, Balance Sheet accounts roll year-over-year. Therefore, if the A/R balance is incorrect it remains so until proper adjustments are made.

What causes Accounts Receivable to reflect an incorrect balance?

- Only one side of a transaction is recorded (the amount to be received or the deposit that has been received)

- Amounts are booked to the A/R that should have been expensed

- This is most common with third-party delivery services that are paid back on a monthly frequency when the fees are lumped in with the receivable account

- Questions that appear on a bank reconciliation are miscoded or are not properly broken out to reduce the A/R Account

How to correct inaccurate balances in Accounts Receivable:

If the A/R Account is overstated (positive above what you are owed):

- If possible, request a transaction report from your vendor with all transactions both paid and owed

- Review the Trial Balance to determine any incorrect coding or activity

- Once the activity is identified, communicate any needed adjustments to your Accountant

If the A/R Account is understated (less than what you are owed):

- Review the Trial Balance to determine any incorrect or missing activity. If items were miscoded, determine which account they should be transferred to

- Once the activity is identified, communicate the activity that is missing or needs to be reclassed to your Accountant

Best Practices within Accounts Receivables:

- Verify with your Accountant that the A/R Account is properly set up based on how it’s utilized, and how you’re recording the activity

- If you’re using the A/R Account for a third-party delivery service, determine if the service can switch to weekly deposits. This will remove the need for an A/R Account and allow visibility into weekly fees and increase weekly cashflow

WATCH THE FULL VIDEO BELOW!

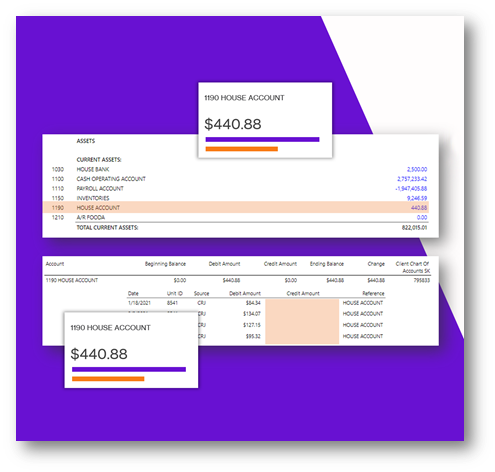

Closing Out House Accounts:

Like A/R, House Accounts in restaurants reflect money that the restaurant is owed. Proper utilization and recording of the A/R Accounts allow full transparency into what is owed. This allows you to hold your partners accountable for reimbursement. Additionally, Balance Sheet accounts roll year-over-year. Therefore, if the A/R balance is incorrect it remains so until proper adjustments are made.

What causes House Accounts to reflect an incorrect balance?

- Only one side of the transaction is recorded (the amount to be received or the deposit that has been received)

- If you record that you are owed the money but don’t record when you’re paid, this account will always hold a false asset value

- Items are coded to House Account that will not be paid back

- There is a vast difference between a House Account and a Comp. If you will not be paid back, set up a custom comp to track the expense to your business.

- These should not be marked as House Account because it is not an asset to your business

- There is a vast difference between a House Account and a Comp. If you will not be paid back, set up a custom comp to track the expense to your business.

- Questions on the bank reconciliation are miscoded

- The amount will be paid back in trade, and not money in the bank

- This situation requires a special setup and should be discussed with your accountant and tax specialist

How to correct inaccurate balances in a Catering Deposits Account:

If the House Account is overstated (positive above what you are owed):

- Run a House Account balance from the POS with all transactions closed to the House Account tender

- Review the Trial Balance to determine any incorrect coding or activity

- Once the activity is identified, communicate any needed adjustments to your Accountant

If the House Account is understated (less than what you are owed):

- Review the Trial Balance to determine incorrect or missing activity. If items were miscoded, determine which account they need to be reclassed to

- Once the activity is identified, communicate the activity that is missing or needs to be reclassed to your Accountant

Best Practices within House Accounts:

- Verify with your Accountant that the House Account is set up properly based on how the restaurant will be paid back

- Verify that the House Account is set up properly in the POS. Prior to set up, determine if the money will be paid back

- If it will be paid back in the future, it will be set up as a House Account non-cash tender

- If it will not be paid in the future, set up a comp button to track the amount comped. This will reflect as an expense on the Profit & Loss Statement and not as a Balance Sheet account