A restaurant Balance Sheet is the most important financial statement an operator has. If the Balance Sheet is not in line and accurate, then there is no question that the Profit and Loss Statement is also inaccurate.

A restaurant Balance Sheet is the most important financial statement an operator has. If the Balance Sheet is not in line and accurate, then there is no question that the Profit and Loss Statement is also inaccurate.

Therefore, there is no precise picture of where actual Net Profit lies. This statement is essential for loan applications, business valuations, etc.

This post covers the basics of understanding how to read a Balance Sheet and how to utilize that knowledge to make profitable decisions to facilitate growth and success.

Understanding the Basics of a Restaurant Balance Sheet

A company’s balance sheet is comprised of assets, liabilities, and equity. The reason this statement is called a Balance Sheet is that the assets must equal the liabilities plus the equity.

Balance Sheet Formula

Liabilities + Equity = Assets

Assets:

Restaurant assets represent items of value that a company owns and has in its possession or something that will be received and can be measured objectively. Good examples include:

House Bank/Petty Cash

- Every restaurant calls this something different (safe, petty, banks, house bank), but unless you are a cashless restaurant, you have some version of this

- It represents the amount of cash you have in your restaurant, NOT including your cash collected for that day’s deposits

- You need to have daily or shift-ly counts of this amount to ensure accountability, prevent fraud and inaccurate accounting

Capitalized Expenses

- If you have a large expense, like a new piece of kitchen equipment for $5,000, your CPA may suggest you treat this as a capitalized cost and record it as a long-term asset on your balance sheet

- This means, the $5K does not hit your P&L statement as an expense within the same period that you purchased it, but it hits your balance sheet as a capitalized asset

- You can set up a depreciation schedule to incur the expense spread out over future periods.

Accounts Receivable

- These are amounts due to your business, but not yet paid for by the customer

House Accounts

- These are similar A/R accounts; you can think of them as Norm at Cheers

- Norm never paid his daily bar tab until a later date. However, the bar still needs to keep track of that amount through a House Account

- Only use House Account and A/R Accounts if you will be paid back in the future

Liabilities:

A restaurant liability is something a person or company owes, usually a sum of money. Good examples include:

Prepaids and Accruals

- Depending on if you’re accounting on a cash basis or an accrual basis, you may have some prepaids and accruals set up

- When considering setting up an accrual, remember the following:

- Managing these accounts can be time-consuming

- These accounts can lead to more work cleaning up your balance sheet at year-end

- When adjustments are made and the accounts are trued up, this could potentially have a negative impact on your Net Profit

- The expense automatically hits every period but you could easily miss a payment if you aren’t paying attention to the declining accrued balance

- When considering setting up an accrual, remember the following:

- Instead of using these options, consider utilizing a budget by expensing as they are paid

- This assists in seeing the true impact to your profit, less the expense in the projected budget

Gift Cards

- Gift Cards are not considered a sale until the time of redemption

- All outstanding gift cards sold are living in your balance sheet until the time of redemption

- It’s important to stay on top of this amount so you have an idea of the amount of unclaimed gift cards floating around

- If recipients redeem these all at once, this means that you receive no cash to help cash flow when these are redeemed

- On the flip side, this can increase cash flow during times where gift cards are being sold (holidays) and won’t be redeemed until the future

CC Tips Payable

- If you’re paying out Credit Card tips collected on paychecks, then the total amount of tips collected for that pay period will show as a credit balance in your liabilities

- At the time of processing payroll, the total amount collected should be paid out in full to your employees.

- If you have any remaining balance then this means that you have either under or overpaid out tips to employees and this will be a red flag if you were to be audited

- It’s critical that you’re reconciling CC Tips Payable to the penny with every payroll that you run

- If you are overpaying the amount collected then that is just cash leaving your account that you’re paying to employees, not collected from guests

Credit Cards

- The Balance Sheet reflects what is owed to any of your credit card vendors and shows as a credit amount

- If you post expenses paid by the credit card that increases the credit amount shown on your balance sheet

- When you post payments to the credit card, it then debits the account until you are paid in full, down to zero

- If you ever look at the Balance Sheet and you see a negative amount reflected, then this is telling you that payments have been made to the balance owed on the credit card but the transactions that created this owed balance were not recorded

- Credit card liability should match your credit card statement

- If you’re carrying a balance month over month, don’t forget to record your interest expense

Due To/From Accounts

- Some restaurants may or may not have the need for setting up Due To Due From Accounts

- This is typically needed when you have one or more locations or possibly a holding or management company.

- Due To/From Accounts are utilized to track money owed to or from a company. This could also be referred to as an Intercompany Receivable.

- Do you need a Due To/From? The only time needed to ensure this is set up is: If you have more than one entity that you are sharing expenses or INV with, etc.

- It is important to record these transfers on both ends – the credit to the company it’s coming out of and the debit to the company it’s going to

Long-term Debt & Owner’s Equity:

Note Payables

- Note Payables is another word for a loan or debt

- These loans are represented on the balance sheet as a liability because you owe this money

Owner/Investor Activity

- This is where owner investments or draws are recorded

- The best practice is to separate this out by investor/owner name

WATCH THE FULL VIDEO BELOW:

Common Balance Sheet Mistakes

Lack Of Frequency Reviewing The Balance Sheet

- Many restaurant operators are diligent about checking their P&L on a regular basis but tend to ignore the balance sheet until the CPA needs to file their taxes at the end of the year

- An inaccurate balance sheet often means an inaccurate P&L

Not Recording All Transactions

- How you pay for items matters. You may be performing a bank reconciliation on your main operating account, thus ensuring that all those transactions are accounted for. But, what about the credit card that you’re not reconciling? Or the cash that you utilized to pay for a delivery?

- Credit card balances should be accounted for as a liability on your Balance Sheet and the balance should be frequently checked for accuracy

- If the balance is misrepresented, you may have expenses that should’ve occurred on your P&L already

- The same idea goes if you pay for something in cash

- Truthfully, this is not an ideal practice, and should be avoided unless absolutely necessary because of the lack of receipts and records with cash transactions – it’s an easy one to miss-account for (or not account for at all)

Recording Loan Payments Without Expensing The Interest

- Every time you make a loan payment, separate out the interest and the capital

- The capital portion should reduce your liability

- The interest should be an expense on your P&L

Not Recording Gift Certificate Liability

- Many operators use gift cards for building future sales, donations, guest recovery, or trades

- They can be a great tool to build business and spread goodwill as part of the community

- To properly forecast cash flow you have to know your outstanding gift card liability

- Operators need to accurately account for gift cards on the balance sheet

- Some restaurants may have a gift card program through their POS, which automatically tracks gift card usage

- If you don’t have that kind of system, it is on you to record the sale and the expense with any gift card you give away

How does the Balance Sheet affect the Cash Flow Statement?

The Cash Flow Statement represents how the Balance Sheet and P&L work together to have an impact on your cash and operating accounts. This is a great way to understand where your money is going. The Cash Flow Statement is the answer to the question, “why doesn’t my bank account balance reflect my profit?”. The more you understand this statement, the better you can forecast your cash flow, and the more you can be strategic and plan out your cash flow activity.

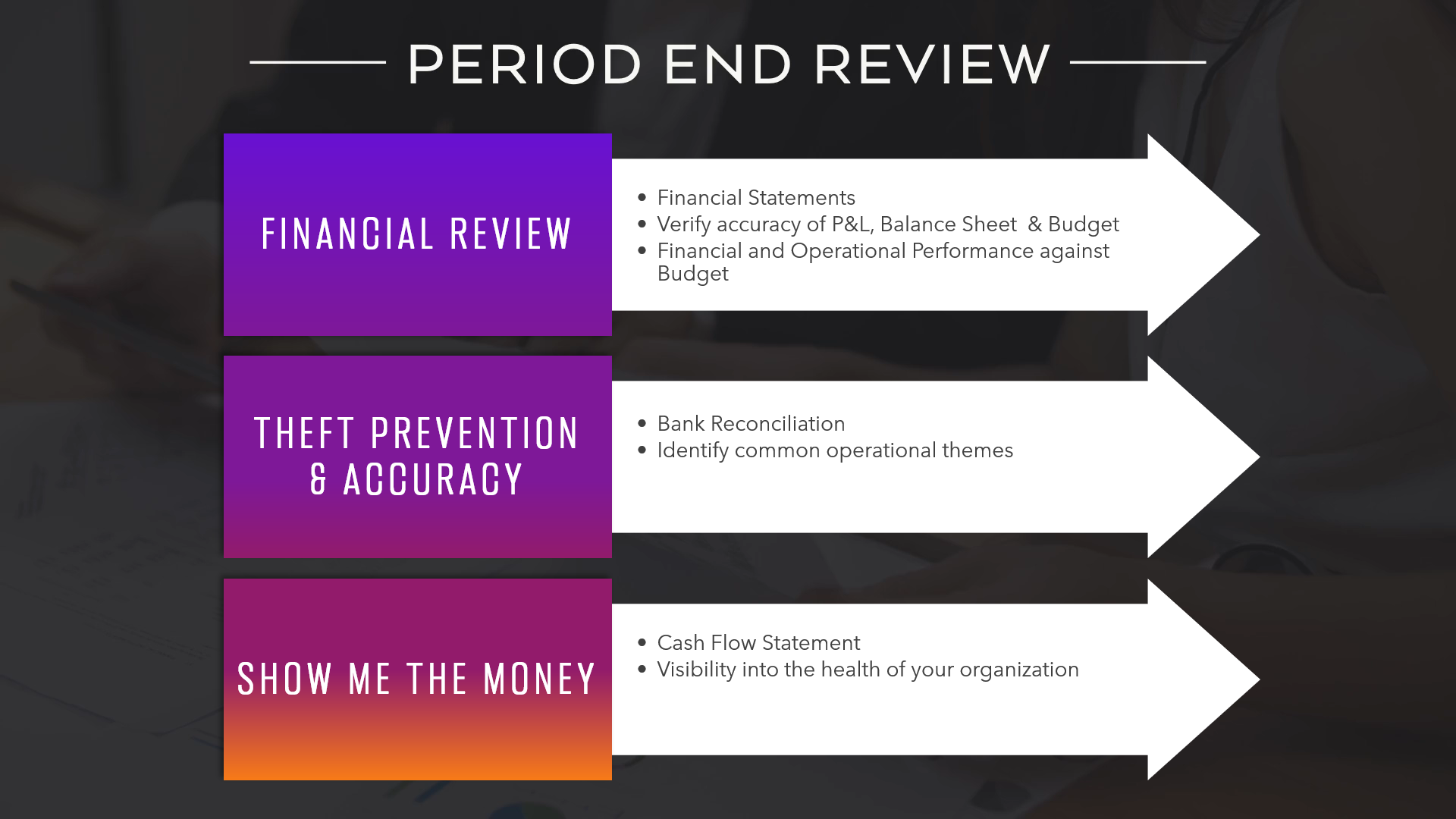

What is a Period End Review?

If you’re going to trust the information on your Cash Flow Statement, it’s crucial that it’s accurate, and in order for an accurate cash flow statement, you need to have an accurate balance sheet. The best activity you can perform to ensure accuracy is a Period End Review.

The three most important statements for you to review at the end of each period for identifying any inaccuracies as well as potential areas of opportunity before heading into the next period are the following:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

Best Practices for a Period End Review

Thoroughly review the General Ledger Register to see all activity in each GL for the period. You can use this to quickly see if there are any vendors or expenses miscoded, or if any large expenses need to be capitalized versus expensed, etc. Another way to review activity on your Balance Sheet is to simply drill down into the values to produce a trial balance. This also shows you the activity for that period so you can quickly verify proper recording.

Before reviewing Financial Statements, verify that the completion of your bank reconciliation:

- Review your bank reconciliation and post any needed adjustments for missing transactions

- Once posted, perform a thorough review of all 3 financial statements and make sure all are posted accurately

- This assists you in identifying any misuse of funds, possible theft, and any possible errors

Ensure you review the Cash Flow Statement:

- This helps you to understand the impact of your period results on your cash flow

- You can quickly identify changes from your financing activity via your cash flow statement

- This shows you how activity from your Balance Sheet impacts your cash flow for the period

- Remember, Net Profit does not equal cash flow, so to truly know what your cash flow for the period is, you need to review your Cash Flow Statement because the Balance Sheet affects this greatly

LISTEN TO THE FULL PODCAST EPISODE BELOW!!